Electronic Funds Transfer

The Fourth Industrial Revolution has disrupted supply chains across numerous industries.

The Fourth Industrial Revolution has disrupted supply chains across numerous industries. The banking industry is among the many industries that have seen major changes. The rise of e-banking has made it possible for the clients to access the entirety of their financial services anytime and from anywhere. Moreover, clients now can play out the entirety of their financial exchanges in this electronic installment framework. Types of e-banking include online banking, phone banking, SMS banking, ATM and debit card services, Point of Sale banking, electronic funds transfer, and many others.

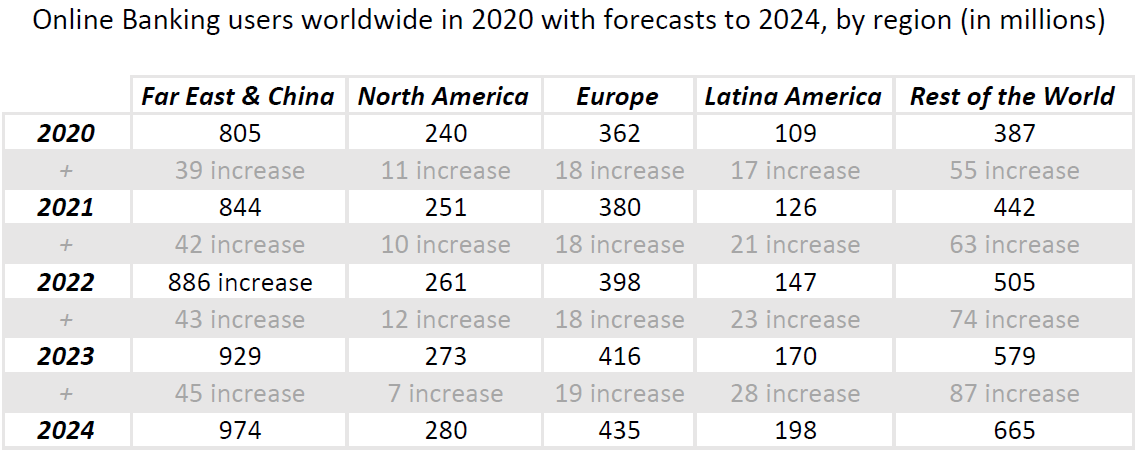

These changes have come in many forms and include multiple factors that have inspired innovation and crisis management to pave the way to the accelerated rise of online banking. As of 2020, there are approximately 1.9 billion individuals actively using online banking globally. Furthermore, the forecasts indicate the number of online banking users to reach over 2.5 billion by 2024. As you can see below:

The rise of online banking also correlates with the rise of electronic funds transfer; which is transferring money online. The electronic funds transfer presents a convenient and secure method of payment for organizations and individuals to manage transactions and payments between multiple bank accounts. Electronic funds transfer offers many benefits including reduced risk of fraud, reduced resource requirements, reduced risk of late payment penalties, more accurate cash flow control, paperless payment audit trails, and lower transaction costs of beneficiary payments.

Electronic funds transfer goes hand in hand with various software solutions. To give an example, Bisan ERP’s Payroll and Attendance module includes the option of paying employees salaries via direct deposit to each employee’s bank account defined in the employee file. Direct deposits are the most popular form of electronic funds transfer. Nonetheless, there are many other electronic funds transfers that exist including wire transfers, online/mobile banking, digital wallets, ATMs and electronic checks.

An electronic funds transfer enhances the efficiency of multi-currency payments and assists in providing an accurate current picture of your cash flow. Bisan ERP offers fully user-defined HTML bank transfer forms that are printed directly from the payment vouchers. Bisan ERP’s banking and check management financial functions ensure great management for multiple bank accounts and multiple currencies, full management and tracking for received and issued checks and bank transfers with full details, including due dates and endorsed checks, in addition to automatic bank reconciliation thus providing an accurate cash flow forecast for each bank account.

Additionally, identical to online banking, Bisan ERP offers the highest security measures and features, among these are control dates. These are a user-defined set of controls for data entry security and control, such as: maximum and minimum allowed document dates from system date; per bank account lock date for reconciled bank statements; data entries lock date for last audited or reporting period. These controls guarantee unintentional data entry that will affect audited or submitted reports.